30+ Borrowing repayment calculator

Find out how much you could borrow with our calculator. Can I still reclaim.

How Is Buying A House With A Mortgage A Good Investment If You End Up Paying Nearly Double Because Of The Interest 350k Loan 3 375 Total Is Over 500k By The End

To help you see current market conditions and find a local lender current current Redmond motorcycle loan rates and personal loan rates personal loan rates are published below the calculator.

. 30 0930 1030 1130 1230. This amount may not be the final amount you need to re finance your property and is used solely for the purpose of providing you with an indication of the loan amount you may require the upfront costs you may incur. The calculator also doesnt factor in interest rate fluctuations.

Use Mortgage Repayment Calculator to calculate monthly extra payments amount of interest paid also with offset account on your home loan or mortgage. How many years are you borrowing the money for. Keep your payslips and your P60 for your records - youll need them if you want to get a refund.

Credit card repayment calculator. The extra amount paid and frequency increase reduces the loan term and total interest paid. Use this simple online mortgage calculator to easily estimate your monthly mortgage payment interest rates and taxes.

Or if youre ready to apply get started. There is no borrowing limit for PLUS loansthey can be used to pay the full cost of attendance. It is the original amount that was borrowed from the lender and had interest applied to it as well as other costs of borrowing such as.

Loan repayments are based on the lowest interest rate either standard variable or 3-year fixed rate owner occupier from our lender panel over a repayment period of 30 years. Initial escrow related funding costs may apply. For borrowings up to 90 including lenders mortgage insurance of the property value.

You choose a fixed amount 20-200 you can save each month for a year which. Property Finance for Expats. 51 Arm Mortgage Rates.

Disclaimer - Borrowing power. Find out the cost of your monthly loan repayments with our real-time business loan calculator. Use our home loan repayment calculator to find out how much your ongoing mortage repayments could be.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. The second tab provides a calculator which helps you see how much vehicle you can afford based upon a fixed monthly budget and desired loan term. A mortgage in itself is not a debt it is the lenders security for a debt.

Find out more here. You can make extra repayments in your online repayment account and by card bank transfer or cheque. To be eligible to apply online you must be at least 18 years of age a permanent resident of Australia applying for.

Use our mortgage repayment calculator to get a quick estimate of your monthly payments for your loan. Mortgage loan basics Basic concepts and legal regulation. The calculated monthly repayment is either halved and paid towards your loan fortnightly or quartered and paid towards your loan every week.

Youll also see your total cost of borrowing including the total interest. Repayment type can be principal and. Other restrictions may apply.

The more income you can prove you earn to a lender the greater your borrowing capacity is likely to be. Of your credit limit the maximum amount you can spend on the card at one time as this shows youre not reliant on the borrowing. Home Loan Repayment Calculator Loan Payment Calculator.

Apply to refinance your home loan with us by 30 September 2022 and settle by 31 December 2022 to receive up to 5000 cashback. Visit now and explore our calculators. A new income-driven repayment plan that will charge 5 percent of the borrowers discretionary income.

Get an online quote in minutes with Fleximize. Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be. Repayment terms vary according to lender terms and how much money is borrowed but monthly payments always contain interest obligations.

An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months. Credit Cards Loans Reclaiming. Todays national mortgage rate trends.

The loan amount has been calculated based on the information input by you and information sourced by third parties. The borrowing amount is a guide only. Estimate your borrowing power and more with our home loan calculators.

How your income and expenses can impact your borrowing power. Rates and repayments are indicative only and subject to change. Loan must be funded by 30 April 2023.

The second monthly payment budget calculator shows how expensive of a motorcycle you can. This calculator figures monthly truck loan payments. Our Mortgage Repayment Calculator is perfect if youre a first-time buyer looking at remortgaging or if youre planning to move house.

Subject to change without notice. To help you see current market conditions and find a local lender current Redmond truck loan rates are published in a table below the calculator. Our student loan calculator tool helps you understand what your monthly student loan payments will look like and how your loans will amortize be paid off over time.

This calculator figures monthly motorcycle loan payments. Rates locked in for duration of loan. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. After 10 years borrowers who originally took out less than 12000 will have the remaining. Customer pays no closing costs.

The term youll repay it over and your small business loan rate. Take your first steps towards homeownership. Choosing fortnightly or weekly repayments will in effect give you an extra repayment every year.

On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. Applications must be received between 31082022 and 30062023 and settled by 30092023. Property insurance is required.

Rate applies for new loans when you borrow up to 60 of the property value with a principal and interest repayment variable rate loan. Choose the term usually 30 years but maybe 20 15 or 10 and our calculator adjusts the repayment schedule. The mortgage repayment calculator is a great way to start but its certainly not a definitive answer and if its not the answer youre looking for our experts can review your full.

Finally in the Interest rate box enter the rate you expect to pay. You can also calculate your monthly repayments and interest rate. By choosing a 25-year loan term instead of a 30-year term your monthly repayments would be 267 higher but you would save 38292 in total loan repayments and in total interest paid over.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. Its important to note the calculator assumes a fixed rate for the entire life of the loan.

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Six Money Challenges To Try This Year Broke On Purpose Weekly Money Saving Plan Money Saving Plan Money Challenge

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

A Loan Of 15 Lacs At 10 Compound Interest Vs Same Amount At 14 Simple Interest Which One Is Better For A Repayment Period Of Ten Years Quora

Predicting Loan Repayment Introduction By Imad Dabbura Towards Data Science

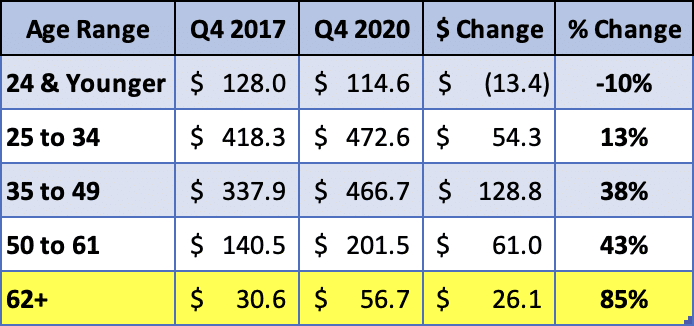

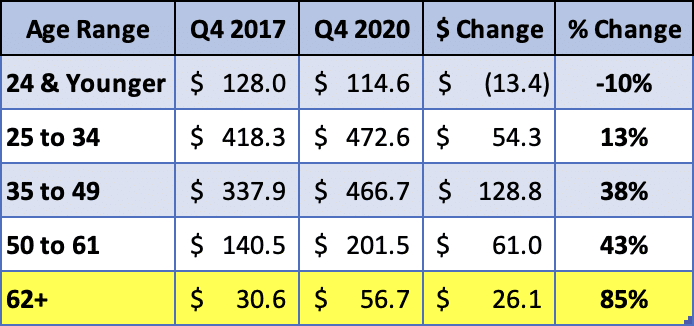

Student Loan Debt In 2017 A 1 3 Trillion Crisis

What Is Amortization In A Loan Quora

Student Loan Debt Statistics In 2018 A 1 5 Trillion Crisis

Online Loan Amortization Schedule Printable Home Auto Loan Repayment Chart Online Loans Amortization Schedule Payday Loans

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Oportun Provides Business Update Oportun Financial Corp

Pin On Lifestyle

Ipmt Function In Excel Calculate Interest Payment On A Loan

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

The Silver Student Loan Crisis Seniors Paying Student Loans Student Loan Planner

Is It Possible To Get A Loan For A House Or An Apartment And Then Rent It Out Until It Pays For Itself Even If It Takes Like 20 Years Quora